May need a significant initial financial investment. Many industrial areas are single-tenant, so having the tenant abandon might leave you without financial investment income while you discover the next renter. And it can be a lot more hard finding renters for commercial areas than for industrial spaces. Again, the specifics vary depending on the type of property you purchase.

Vacant land is just as important as what can be made with it. Purchasing acres and acres in Middle-of-Nowhere, Wyoming will not do you much excellent. But buying some land beyond quickly broadening metro areas like Austin, TX could settle huge in the long-term. The reliable method for generating income in uninhabited land is to purchase where you anticipate people to expand, and offer to designers once the expansion reaches your land.

If the land is fertile, you might rent the land to local farmers. The initial financial investment may be small, and the potential return on financial investment is extraordinary when you can buy acres for pennies and offer them for thousands. In a lot of cases, there is no maintenance needed. If there is nothing on the land, there's absolutely nothing producing an ongoing cash flow.

Find some vacant land with prospective and buy it. Now you're a genuine estate financier! All the home classes we just covered as buy-and-hold options can also be purchased with the intention of turning them. You purchase the residential or commercial property, improve it, and sell it within a matter of weeks or months.

Improving the home with a two-month renovation will naturally increase the resale worth, however will it increase the resale value enough for you to recoup all your expenses of materials and labor plus your closing expenses and your home mortgage, tax, and insurance costs throughout the few months you own the property? And still turn an earnings large enough to make the job worth the effort? And are you sure you'll be able to offer instantly? Having a flip rest on the market for months while you make the home mortgage payments is not a position any flipper wishes to be in.

Little Known Questions About What Is Puffing In Real Estate.

This is best performed in a super-hot market where residential or commercial property values are increasing every day. how to generate leads in real estate. You want the property to grow in worth throughout the brief period in which you own the residential or commercial property, even without your improvements. That's how you can be confident that you'll have the ability to sell for more than the purchase rate plus expenditures.

Flipping has the possible to make you a significant revenue in a brief time period. You'll either be doing all the work yourself or relying on contractors to complete the work on time and on budget plan. Flipping is riskier than buying and holding because if you get the timing of the marketplace incorrect, you could lose cash on the deal.

Do your marketing research. Short-term market patterns are crucial to success and failure in turning. Make certain you understand exactly what your market is doing, and you are positive that values will continue to climb for the time it will take you to buy, remodel, and offer a home. 1.

Know where you can get products, just how much the flip will cost, and how long it will take. 1. Aspect closing costs (on both the purchase and sale of the residential or commercial property) into your possible earnings computations. 1. See if a knowledgeable flipper would be willing to partner with you on a deal.

A typical excuse for not investing in property is the preliminary down payment required to acquire a home. That deposit is a sound financial investment, but it's also a lot of cash to the majority http://emilianosaic269.wpsuo.com/indicators-on-how-to-syndicate-a-real-estate-deal-you-need-to-know of individuals. Well, you can't use that as a reason any longer. Since we live in the age of crowdfunding! Crowdfunding permits you to pool your preliminary investment with other financiers.

Things about How To Get Started In Real Estate

This could be a buy-and-hold residential or commercial property, a flip, and even an expensive advancement job. This isn't a brand-new concept. "Real Estate Financial Investment Groups" have been around forever as a way to help financiers with little capital start in realty investing. But today's crowdfunding systems make the procedure easier than ever.

And you don't have to be an accredited financier to participate as you did in the conventional genuine estate investment groups. Crowdfunding is normal people, like you, sharing in the risk and the reward of real estate investing. You can become a real estate investor today, with as little as $500.

You do not have as much control as you do when you own the home alone. If the job is a flip or an advancement, you have to actually rely on the job's handling group given that private investors are not likely to have any say in how the job is handled. 1.

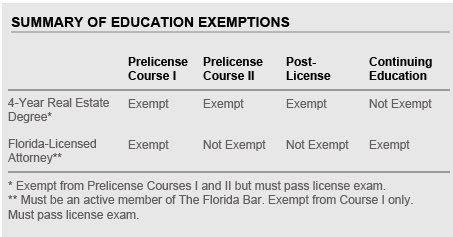

1. Get knowledgeable about the kinds of offers readily available to financiers and check out the fine print to ensure you comprehend the regards to your investment. 1. Create your account, pick your job, and send in your money. 1. Congratulate yourself on becoming a genuine estate financier, and wait for your payday! Having your realty license isn't legally required for genuine estate investors.

The education you get in your pre-licensure coursework will be indispensable as you navigate through your realty investment transactions. You'll comprehend all the legal jargon and will understand exactly what to look for in the contracts to make sure you're getting the best deal possible. As Armstrong Williams stated, "Something I inform everyone is learn more about realty.

How Much Money Do Real Estate Agents Make Fundamentals Explained

So you will not have to pay another licensed realty agent to facilitate your transactions. Consider this for a moment. Let's say you're turning a house in Austin, TX. You can buy the home at $300,000, refurbish, and sell at $400,000 (to utilize some great, round numbers). You'll be your own agent for the purchase, so the seller will pay you 3% of the $300,000 purchase rate as the purchasers' agent.

Then when you offer at $400,000, you're your own qualified agent once again, so you don't need to pay somebody the 3% listing representative commission. That's $12,000 saved money timeshare calculator on this end of the deal. So on one flip, you can come out $21,000 ahead by having your realty license. That makes the $500 licensure classes (plus the small license application and processing costs) look like nothing! You'll likewise be getting top-notch service on your self-service genuine estate offers because you'll have access to all the resources of the licensed realty pros.

Your realty license gets you to access all of it. However potentially the biggest benefit of getting your real estate license as an investor is the network you'll access to. Your realty license will enable you to join expert organizations where you can connect with other industry insiders.

This track record might bring you, like-minded investors, who are willing to pay you to assist them navigate a financial investment offer, or who are aiming to partner with you on a deal Even if you decide crowdfunding is the best option for you to become a real estate investor, you can still timeshare companies reviews put your license to utilize.